17 February 2022

While a diplomatic resolution may still be found, both President Biden and NATO have warned in the last few days that a Russian invasion of Ukraine is still possible, with no signs yet of de-escalation on the Ukrainian border.

The human and economic cost of conflict is well-known, but there can sometimes be secondary implications for markets. Paul Craig, portfolio manager at Quilter Investors, looks at past incidents of conflict to consider whether there are wider considerations for markets and investors.

“With conflict, the human cost will always come first. But conflict inevitably also has an impact of the belligerent’s economy, sometimes extending too to the global economy. Despite the damage and destruction that results, the impact of conflict on stock markets is unpredictable and more often than not relatively muted.

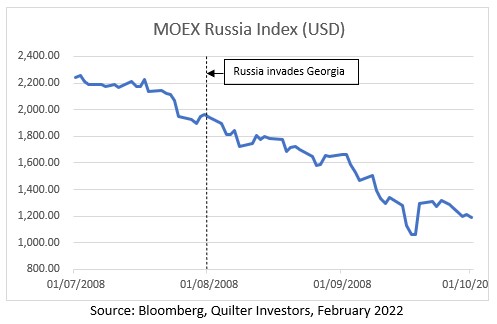

“For the main aggressor, the period leading up to the start of a conflict or invasion tends to be marked by stock market declines or increased volatility as investors grapple with the extent of its social and economic implications.

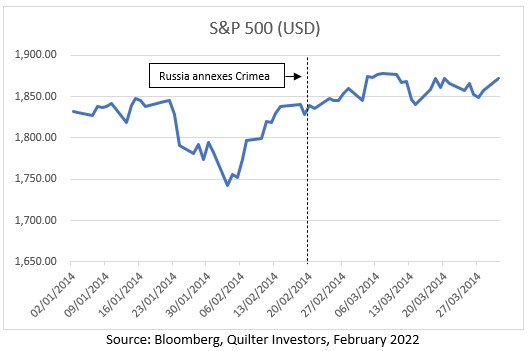

“We saw this in the Russian stock market in the run-up to the 2008 Russian-Georgian conflict and the 2014 annexation of Crimea by Russia.”

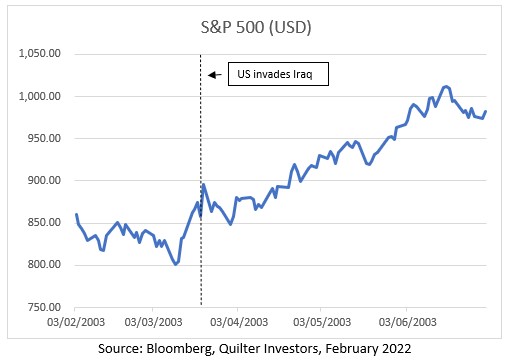

“But there can also be a paradox in some cases, when conflict actually brings positive movements in markets. We saw this when the US invaded Iraq in 2003. The strength of the initial conflict led the market to believe that the fighting would end much earlier than expected. This was rather poignantly emphasised with a CNN article at the time titled ‘bombs fall, stocks rise’.

What about third-country markets?

“In the past, Western stock markets have largely been non-plussed by Russian aggression. There has been some additional volatility, and we did see some weakness in 2008 and 2014, but this was never really sustained. In fact, markets were more responsive to weak company results than wider geopolitical events, as should be expected.

“And in the long-term markets have historically shrugged off the threat of conflict. Which is no real surprise. Investors shouldn’t really be re-positioning their portfolios because of short-term geopolitical events.”

Is this time any different?

“This time is different in that it has geopolitical implications for the energy market. The problem for investors at the moment is the threat of inflation, and the risk that it becomes sustained over the medium-term. An invasion of Ukraine, along with the inevitable reaction from the West, would potentially threaten essential crude oil and natural gas supplies from Russia.

“This has always been the risk when implementing sanctions on Russia, but this time it will likely result in energy price inflation becoming sustained. If consumers adjust their expectations as a result, and rightfully start asking for higher wages, then inflation could become a vicious cycle, and could be a real threat to markets.”

What should investors do?

“The key message for investors is not to get sucked in by the noise. Corporate earnings and the economic environment are going to be more important for markets than conflict politics in the medium-term. Trade flows to and from Russia in the global context are small.

“Markets are always volatile between the Fed talking about rate hikes and them lifting them. Combine this with the speculation around inflation and growth and you have grounds for volatility for some time to come.

“In this environment, high quality businesses should benefit from the ability to pass on input cost increases onto customers, and it is here that investors should focus.”