13 September 2022

David Henry, investment manager at Quilter Cheviot:

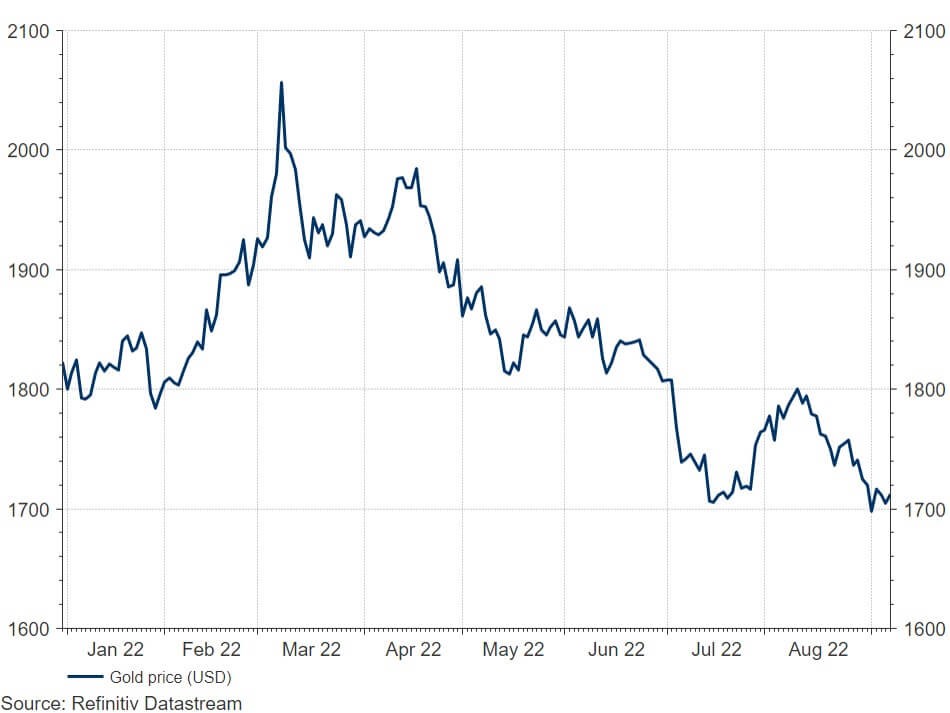

Rampant inflation, geopolitical turmoil, recession fears and rock bottom sentiment. If you were asked to come up with an ideal environment for gold, you could do worse than replicate the current state of the world. And yet…

This one is a bit of a head scratcher on the surface, a lot of the theoretical bull arguments for gold have materialised this year and the asset has gone nowhere.

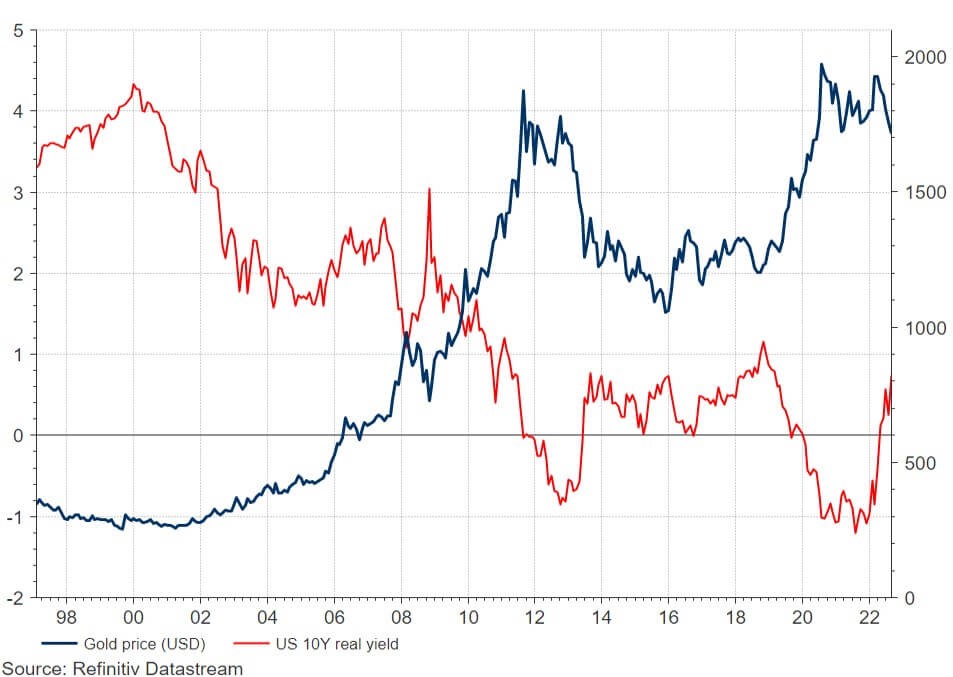

Gold was the best performing asset class during the 1970s, with the price appreciating more than ten times higher in dollar terms. The narrative since then has followed that gold must be a decent inflation hedge, but as we see from the below, the truth is not this straightforward.

Yes, gold did well during the 70s – but inflation has not always been a good predictor of the price. For instance, the gold price did not do much from the mid-1980s into the end of that decade, a time when inflation was ticking up. Ditto the late 90s. We also saw gold take off in a deflationary environment precipitated by the Great Recession in 2007/2008, but only sadly after the UK government had sold more than half of the country’s holding. As an aside - I can remember all of the ‘cash for gold’ shops opening in my hometown around this time, all gone barely five years’ later.

So, what about recessions? Gold is an asset that people typically buy when they are fearful – a shinier version of “money under the bed”. Given that recessionary storm clouds seem to be gathering, should we expect this to be a catalyst?

Sadly, again, it is not that straightforward. Gold price performance during every recession since 1970 has been positive, but hardly a home run every time.

|

|

Dec 1969 – Nov 1970 |

Nov 1973 – Mar 1975 |

Jan 1980 – July 1980 |

July 1981 – Nov 1982 |

July 1990 – Mar 1991 |

Mar 2001 – Nov 2001 |

Dec 2007 – June 2009 |

Feb 2020 – Apr 2020 |

|

Gold price (USD) |

5.5% |

80.4% |

17.2% |

2.5% |

0.9% |

3.3% |

19.9% |

7.4% |

Like most (nearly all) questions in investing, there just is not one straightforward answer. The price of gold is ultimately determined by supply and demand. Supply is easy, there is a finite amount of this stuff in the world. Demand is trickier. It is driven by a confluence of factors, some of which can provide conflicting forces, and getting a handle on which one is dominant at any given time is largely impossible.

That being said, we can still have a go.

I think that this is what matters at the moment. A gold bar generates no income – and therefore the opportunity cost of holding the asset rises during periods when the income one can get from cash (interest rates) also rises. Per the awful performance of the bond market year to date, income yields have risen to beyond the market’s expectations of what average inflation will be over the next ten years - referred to as the “break even” inflation rate. In this environment, the relative attractiveness of a lump of shiny metal which does not pay you anything diminishes.

Full disclosure – the lack of income offered by gold has always made me wary of including it within portfolios. Valuing an asset that throws off no income (cf. bonds) and has no underlying earnings (cf. company shares) is an exercise in regarding supply versus demand only. As I have mentioned above, this can be a very murky exercise. The analogy that I have used in the past is that valuing a gold bar can be like playing poker without looking at your cards – if you aren’t able to make a reasonable attempt at valuation it is a struggle to know what the odds of success are.

Ultimately, most investors hold gold within a portfolio because it dances to its own beat. The asset has historically moved in different directions to other traditional portfolio investments, seemingly at random. Therefore, it can help risk conscious investors diversify their wealth. Just bear in mind that there are no guarantees that gold will rise when stocks or bonds fall, just as we have seen this year.

As a final thought on gold, I have observed over the years that more than any other asset, with the exception of cryptocurrency, it polarises opinion. Few people seem to be “on the fence”, with evangelists on both sides. Not a helpful environment for nuanced debate. In my view, and as a general rule of thumb, it pays to keep an open mind and to cast your investment net as wide as possible. Never is a big five letter word.