22 February 2022

If you are covering the latest IHT receipts, please see the following comment from Shaun Moore, tax and financial planning expert at Quilter:

“The latest figures show the Treasury received £5bn in inheritance tax receipts in the financial year up to January 2022, an increase of £700m in the same period a year earlier. Sustained property price growth and asset price inflation has pushed up the value of estates, meaning higher IHT receipts for the government.

“IHT was once viewed as a tax on wealthier individuals, but the reality is that the average UK property is only £50,288 short of the standard NRB. With the NRB and RNRB frozen until 2026 and house prices still on the up, many more people could face a hefty IHT bill.

“The residence nil rate band was introduced in 2017/18 to account for rampant house price growth, but as a result we have an incredibly complex IHT system, which is poorly understood and therefore poorly planned for. In fact, the OTS has said that the RNRB is one of the ‘most complex’ areas of IHT and even said that some solicitors choose not to advise clients on the RNRB because it is too complicated.

“Perhaps now is time for a rethink of IHT to make the regime as easy to understand as possible for IHT payers.

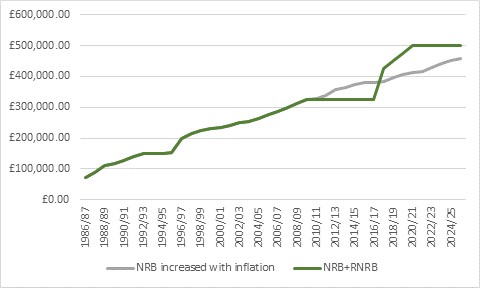

“For example, combining the nil rate band and residence nil-rate band would give someone an effective nil rate band of £500,000 in 2022/23. If instead the government left the nil rate band to increase in line with inflation from 2009/10, it would have been worth £428,000 in 2022/23.

“While less than the current combined nil rate band and residence nil rate band, it would be considerably less complex for estates to plan for and It would increase fairness in the system, given the RNRB is only claimable when the family home is inherited by lineal descendants.

“And with sustained inflation, the nil rate band increased with inflation will eventually converge with the combined nil-rate band and residence nil-rate band:

*Assuming 3% inflation in 2022/23 and 2% thereafter

“Surely some simplification can be found by only having the one nil-rate band, which is reflective of house price growth and inflation?

Ways to lower your IHT bill:

Making full use of any allowances:

“The current IHT system allows up to £175,000 of the family home to be passed on tax-free, which is effectively doubled to £350,000 when combined with the allowance of a spouse or civil partner. On top of this, the £325,000 standard nil-rate band is available, meaning it is possible to pass on £1 million IHT free as a couple. However, it is important to remember the RNRB only works for those with direct descendants to inherit the family home and is capped at the value of the property being inherited – less any outstanding mortgage.”

Making a gift to family members:

“There are other ways to reduce IHT exposure, such as gifting to family members. Gifts to spouses or civil partners are completely free of IHT and each tax year up you can gift up to £3,000 with your annual exemption, so as a couple this could be a combined £6,000 a year. In addition, there is no limit on excess income – above normal expenditure – that can be gifted.”

Considering a transfer:

“More significant gifts classed as Potentially Exempt Transfers (PETs) or Chargeable Lifetime Transfers (CLTs) will take seven years to see the IHT benefit. As well as reducing the taxable estate value, larger transfers can be particularly useful for estates of more than £2 million which are impacted by the RNRB taper as the gifts can immediately reclaim the extra band.”