21 January 2022

2021 was a year of heightened risk for emerging markets, with EM equity markets struggling to regain momentum after a strong 2020. The New Year promises more of the same, argues Sacha Chorley, portfolio manager at Quilter Investors, with a few key risks on the table that could knock investor returns going into a critical year.

“Last year was tough for emerging markets. Covid-19 infections increased rapidly in some countries, none more so that Brazil and India, which required further public health interventions from governments. In short, battling Covid-19 was once again a big strain on government effort.

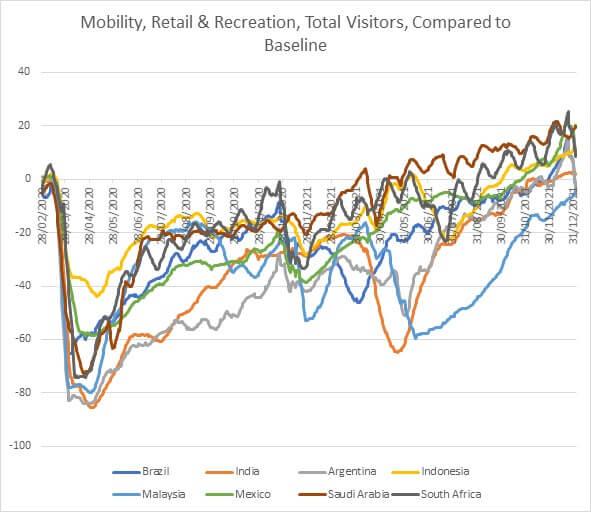

“However, there were two big positives. The first of which was that the huge fiscal programmes enacted by EM governments 2020 started to trickle into their economies, which had a positive impact on consumer spending and local mobility.

Source: Macrobond, Google Mobility Data, January 2022

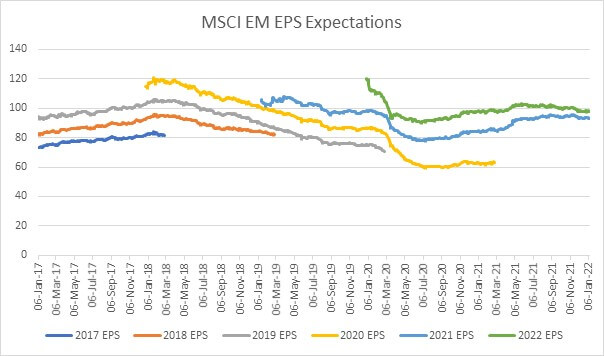

“The second was that earnings growth remained strong for EM firms in 2021 and earnings for 2021 almost matched expectations made pre-pandemic. Valuations were not quite so strong, offsetting the gains made from those increased earnings.

Source: Factset, MSCI, January 2022

“2022 should see this earnings growth continue, and possibly a stabilisation in valuations as well. But a few key challenges remain that investors should pay close attention to in 2022.”

Avoiding Omicron

“Economic growth is no friend of lockdowns, so during 2021 growth came to a stop in many EM economies as a result of the public health interventions required to counteract the increase in Covid-19 infections. Since then, EM economies have struggled to generate growth in consumer spending and services activities, which has weighed on economic growth. EM economies have done well to boost vaccination rates over 2021, which are catching up quickly to developed market counterparts.

“However, like most economies, EM growth in 2022 will be heavily dependent outcomes of the surge in Covid-19 cases driven by Omicron. While there has been good news from the UK and South Africa on the efficacy of vaccines and boosters, the path of growth in 2022 will be dependent on governments being able to manage outbreaks, which could be a challenge in EM countries where vaccination rates are weaker. However, if the Omicron strain turns out to be less severe than previous strains, then there is less need for government control.”

Controlling inflation

“The world is currently experiencing severe inflationary pressures, and EM economies are no exception. There are many interweaving dynamics at play here. After the pandemic-induced slowdown in economic activity, governments responding with massive fiscal programmes which increased the money supply significantly, contributing to inflationary pressures. Global demand for commodities has also put upward pressure on producer prices and food prices, which typically form a significant proportion of EM consumer spending.

“Taken together, these dynamics have made consumer prices very high in EM economies, which requires careful action from central banks to avoid inflation spiralling out of control. Should inflation spiral, EM central banks may struggle to control runaway prices resulting in a currency depreciation. The devaluation of EM currencies will knock investor returns in these equity markets. It’s fair to say that EM authorities are walking a tightrope when it comes to managing inflation in 2022.

“And there are important political considerations, too. Historically, prises increases for food and other essential goods have caused political unrest and the current bout of price hikes will be extremely hard to manage by EM politicians, especially those with Central Banks that aren’t necessarily independent. While a multitude of factors explain the current unrest in Kazakhstan, fuel price hikes are an important one.”

Dollar Dependency

“The final challenge for emerging markets in 2022 will come from the potential strength of the US dollar in the face of rising interest rates. As a rule of thumb, EM economies and markets tend to perform well when the dollar is weak as a weak dollar lowers the cost of borrowing. However, the converse is true with a strong dollar. A strong dollar results in a drag on EM economies as it can increase the cost of borrowing and cause a tightening of global dollar credit supply.

“Predicting medium-term exchange rates with any certainty is always challenging. The dollar is strong at the moment, but if growth in EM economies is higher than expected, and higher than growth in developed markets, then the US dollar should weaken. However, until then, a strong US dollar may pose a challenge for emerging market economies and equities.”