9 September 2022

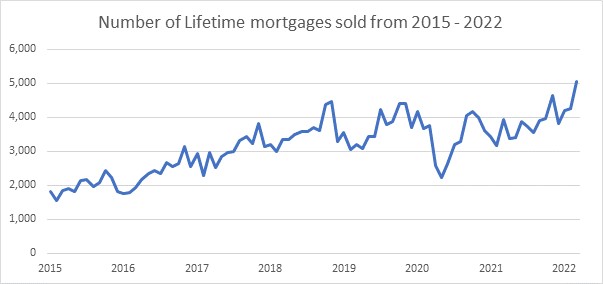

Freedom of Information data collected by Quilter, the financial adviser and wealth manager, reveals that sales of lifetime mortgages are on track for a 91% increase in 2022 compared to eight years ago.

Data covering the first three months of 2022 reveals the average number of lifetime mortgages sold is already standing at 4,500 per month compared to an average of 2,358 per month in 2016 and just 1,978 per month in 2015.

If current trends persist, there could be as many as 54,000 lifetime mortgages sold in 2022 - nearly 10,000 more than in 2021 when a total of 44,793 lifetime mortgages were sold with an average of 3,733 sold a month.

The data also reveal that the most popular loan-to-value (LTV) band for lifetime mortgages is 10-20% with an average of 916 mortgages sold per month since 2015 and a total of 79,699 up to March 2022.

Comparatively, on average 39 lifetime mortgages in the 50-60% LTV band were sold each month since 2015 with a total of 3,394 sold up to March 2022. However, the popularity of higher LTV lifetime mortgages has increased in recent years with the average sold between January 2021 and March 2022 sitting at 67 per month. Comparatively, 33 50-60% lifetime mortgages were sold per month on average up from January 2015 to December 2020.

A lifetime mortgage is a type of equity release product, providing a loan secured against your home that allows you to release tax-free cash without needing to move out. Lifetime mortgages are available to homeowners aged 55 or over. You can take the money as a lump sum or as series of lump sums.

A lifetime mortgage is just one type of equity release with the other product called a home reversion plan. This plan enables you to raise money by selling all or part of your home while continuing to live in it until you die or move into permanent residential care.

Charlotte Nixon, mortgage expert at Quilter says:

“Equity release can be a useful product for some people depending on their financial circumstances. However, it is worrying that the rise in the popularity of this product coincides with the cost-of-living crisis. Taking equity out of your home, which you have spent years paying off should not be taken lightly and you should have a long-term plan for what you do with that equity rather than use it simply to help pay monthly bills or feel like you have more cash in your pocket for the here and now.

“Anyone interested in the possibility of equity release should seek financial advice, which preferably looks at your wealth and financial aspirations in the round and not just your mortgage requirements.

“There is no getting around that this product does carry significant risks. Lifetime mortgages charge compound interest so failing to keep up with your payments could mean that the entire sum borrowed compounds.

“However, this product can be useful for people that have built up a life in a particular community that they are unwilling to move out of as you can release capital but still live in your property. Considering house prices have soared in recent years the prospect of downsizing but staying within a particular area is not feasible. Seeking out professional advice before making any decisions is crucial as it can have long lasting and devastating impacts on people’s wealth if it goes wrong.

“Similarly, equity release might be used to fund care costs when people think they have no other choice. The care system is tricky to navigate, and equity release might not be the best option particularly if you need to move into long-term residential care. Everyone’s finances and needs are different which is why it’s so important to get advice if looking to take out a product like this.”