4 August 2022

If you are covering The Bank of England MPC decision to increase interest rates to 1.75%, please see the following comment from Karen Noye, mortgage expert at Quilter:

"The rumour mill has rightly predicted that today the Bank of England has made its biggest rate rise for 27 years, increasing the base rate to 1.75% increasing by 0.5%,. This will only spell bad news for anyone with a mortgage.

"Up until this point, the increase in interest rates would have meant a relatively small rise in mortgage bills but this hike will certainly start to hit people’s budgets at a time when funds are already stretched due to the cost-of-living crisis.

"Those on fixed rate deals might still be feeling protected by their deal. However, unless you have recently opted for a long fixed rate deal then it is likely you’re going to need to face the music sooner rather than later when your current deal comes to an end. In the next year, there will be thousands of borrowers forced to walk out into a completely different interest rate environment and secure a new deal. This means there will be a slew of new borrowers suddenly having to partake in the misery that those struggling with tracker or standard rate mortgages are already bearing.

"For context, someone who took out a mortgage worth £250,000 over 25 years at around 1% would pay roughly £942 per month. After today’s rise to 1.75%, someone borrowing the same amount but at 1.75% would pay £1,029 per month. What’s more is that if interest rates continue to climb to 2.5%, monthly payments would soar to £1,121, a nearly £180 difference. This kind of pressure would certainly force someone to have to live their life differently to meet the new costs.

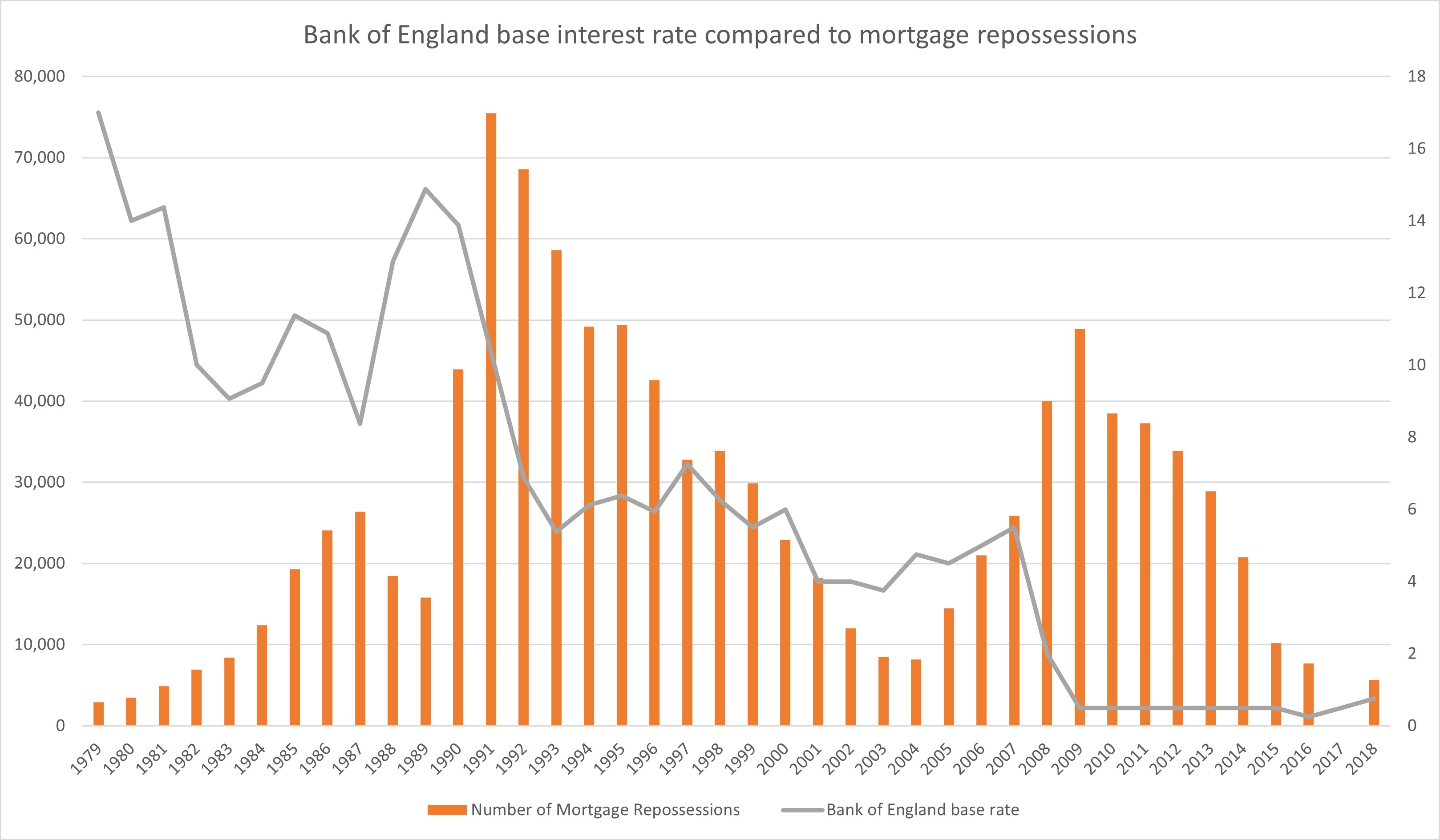

"Quilter analysis* of the number of mortgage repossessions per year when compared to the Bank of England base rate shows that changes to interest rates can correlate with the number of repossessions that take place in a year. As interest rates climb we may well see repossessions climb with them as people struggle to make ends meet and sadly lose their house as they fall into arrears.

"This could have a material impact on house prices as once these repossessed houses are put back on the market by lenders it would naturally push prices down as it becomes a buyer’s market where there is more stock than demand.

"This hike in interest rates comes just after the Bank of England loosened its affordability rules in a bid to make it easier for people to get on the housing ladder. With affordability now front of mind of people this came at an odd time. However, for the time being lenders are unlikely to make sweeping changes to their affordability tests in response considering the nation's finances look so precarious.

"The rate rise once again puts first time buyers in last place for trying to get their first home. They now not only have to contend with ever increasing house prices but they also have to cope with the increasing cost of living along with inflation eroding any deposit they have managed to save. Unless this rate rise causes a significant house price correction the dream of owning a home continues to be pushed further and further from reality for large swathes of the nation. Their only hope is a significant drop in house prices although with the market suffering a housing drought that doesn’t seem likely unless many more properties come onto the market. A rise in interest rates might just cause this."

*Analysis uses figures from BoE interest data using end of the year base rate and figures collated by https://www.ticfinance.co.uk/stats/ which uses data from gov.uk.