8 April 2025

With global stock markets in the midst of a period of extreme volatility following the introduction of fresh tariffs across the board by the US, Quilter is reminding investors of the principles to stick to, helping them navigate such uncomfortable periods.

Marcus Brookes, chief investment officer at Quilter Investors, commented: “Panic can quickly take hold in financial markets, and this permeates down to ordinary investors fretting about their own portfolios and wealth. This is completely natural given the uncertainty of what is happening and what could come next.

“However, across decades, share prices have invariably risen and fallen and have seen off past crises that have appeared far worse. Investing for the long-term and riding out the volatility is not only the best strategy to preserve wealth, but to also grow it. Investors should, therefore, seek out opportunities in weaker markets and focus on their financial plans and the reasons for being invested. This difficult period will pass, and as a result it is crucial investors are there for the better days ahead too.”

Brookes outlines below the seven principles of investing so people can keep their heads during times of market stress.

1. Get Advice

“Everyone’s needs are different and as such not everyone can take the same level of risk. As such, it is vital that you have a plan that is tailored for you and that you are prepared for periods of market volatility.

“Financial advisers will aim to know you are your circumstances inside out in order to help navigate you on your investment journey. Furthermore, in more turbulent times, they can be a source of sage advice, helping you to take the emotion out of investing and provide an objective view. This will help you remain invested, potentially by tweaking your holdings and ensuring you have the right mix of assets for your situation. It may just be the best investment you ever make.”

2. Make an investment plan and stick to it

“It is one thing to have a target, but a sound financial plan can be the difference between simply hoping for the best and actually achieving your goals. Ask yourself, what is your money for, when do you want to access it, and how you plan to achieve it.

“By going through this exercise, you can be focused on your long-term aims without being distracted by short-term market changes. Financial advisers can help you with this or you can come up with your own plan. This will then help you decide where to put your cash to work and create a positive investing mindset. Be wary not to be unrealistically ambitious, however, as this could also derail things.”

3. Invest as soon as possible

“When it comes to the investing part of it, the earlier you do it the better. The magic of compounding returns allows investors to generate wealth over time, and requires only two things: the reinvestment of earnings and time. The difference of just a few years can make a massive difference to your end result.”

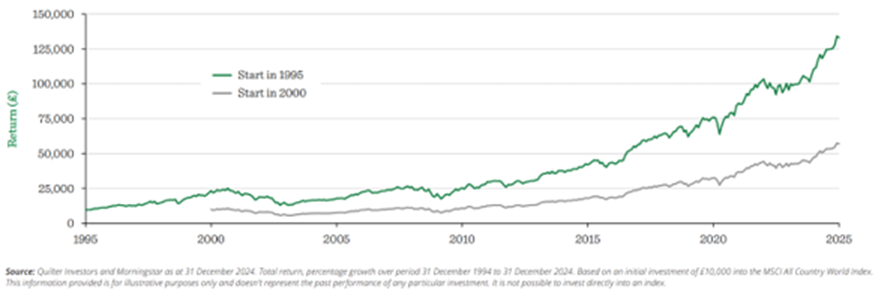

The chart below shows two investors who both invest £10,000 into global equities. However, Investor A did so in 1995, while Investor B s

tarted five years later. Over 30 years, Investor A has accumulated £64,791 more in returns compared to Investor B. If Investor B wanted to accumulate the same size of pot, they would have needed to make an initial investment of £20,756.

4. Don’t just invest in cash

“When markets are volatile it’s a big temptation to put all your investments in the relative safety of a cash savings account. It may seem like a safe bet, but it is anything but. Inflation of just 3%, just a fraction above the current rate of 2.8% in the UK, would see £10,000 almost half over 25 years. So, £10,000 today would only have the purchasing power of £5,537 in 25 years’ time. A 5% inflation rate would make that £10,000 worth just £3,769 in 25 years.

“Every investor does need at least some part of their funds in liquid investments in case of an emergency, but low risk usually leads to lower returns. These tariffs are expected to put prices up and cause a fresh bout of inflation. Equities offer investors the best chance to beat inflation and protect their wealth over the long-term and as such investors need to consider the risk they are taking.”

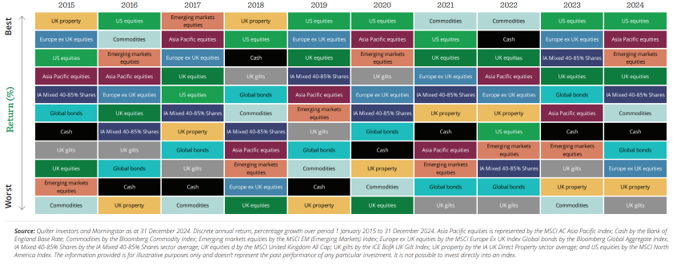

5. Diversify your investments

“When markets are fluctuating wildly it’s all too easy to worry about the performance of certain investments while forgetting about the bigger picture. Similarly, when one asset class is performing poorly others may be flourishing – US equities being a case in point right now having performed strongly in 2024. A diversified portfolio including a range of different assets can help to iron out the ups and downs and avoid exposing your portfolio to undue risk.”

6. Invest for the long-term

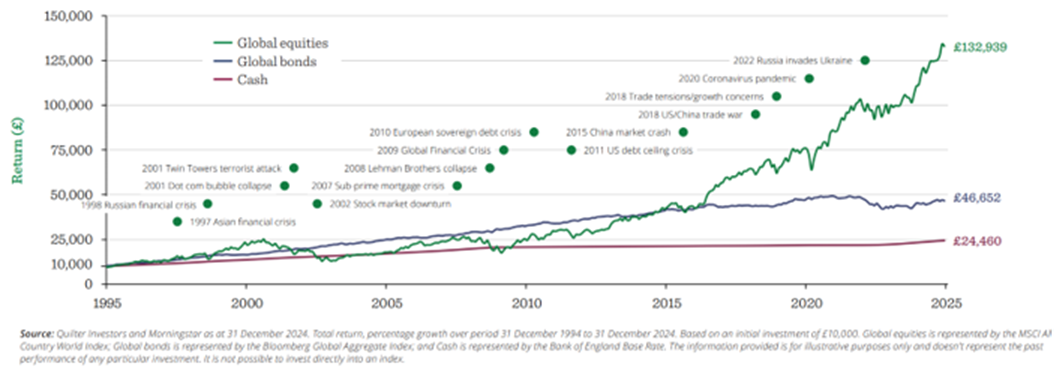

“As investors there are many ways we can help to reduce the effects of volatility on our portfolios. Using falls as buying opportunities or drip-feeding money into the market is a good way to do that, but the number one thing is to use time to your advantage. No one knows with certainty when markets will rise or fall, so trying to time the market is not only stressful, but also very seldom successful.

“Investing is a long-term game and that is the best way to ride out these periods of volatility – the chart below shows how stock markets have seen off past crises. The sooner you can start investing, and the longer you can invest, the more likely you are to have the potential for healthy returns and achieve your financial goals, regardless of short- term blips.”

7. Stay invested

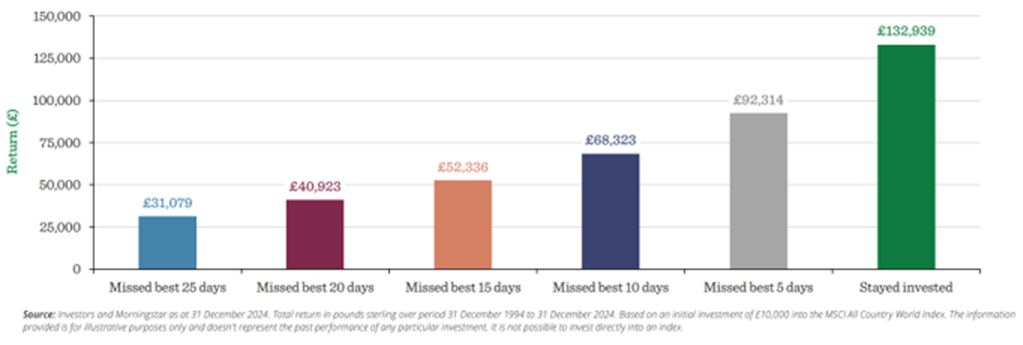

“When markets are volatile, it is often tempting to exit the market or switch to cash in an attempt to reduce further expected losses.

“However, it is impossible to time these movements correctly as no-one has a crystal ball to predict future movement. Being out of the market for just a few days can have a devastating effect on returns, and the numbers proving this are stark. The best days often follow the worst, so it is most important to make a plan, stick to it, and don’t try to time the market.